- Bransch

- Tech Venture Builder

- Lista

- Spotlight Stock Market

- Emissionsvolym

- 18,5 MDKK

- Teckningskurs

- 8,25 DKK per aktie

- Teckningsperiod

- 21 februari – 7 mars

- Garanti- och teckningsåtagande

- 80 %

- Pre Money-värdering

- 40,3 MDKK

INFORMATION OM EMISSIONEN

https://www.meew.dk/investor-relations/

Teckna via Nordnet

Länk till Memorandum

INTRODUCTION TO MEEW

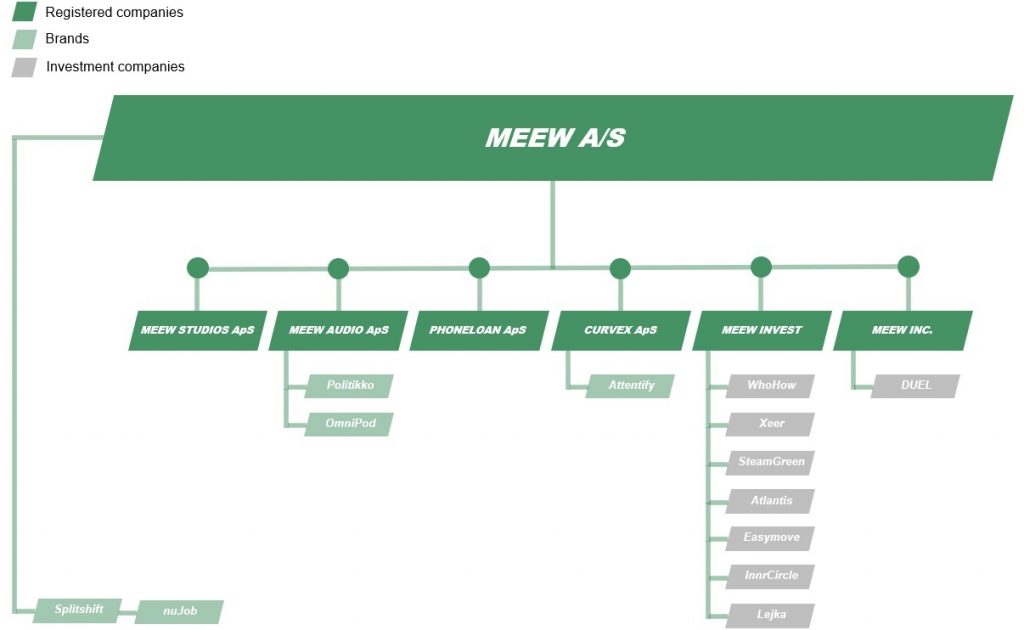

MeeW A/S (“MeeW” or the “Company”) consists of a group of independent subsidiaries and brands with a common focus on being a venture builder within technology, digitalization and automation, where the main businesses of the Company are focused on SaaS development, IT consultancy and IT investments. The revenues created are mainly used to organically develop and launch new technological brands for the group, create new services for clients, and to invest in tech pioneers. MeeW is strategically structured as a group to ensure a manageable and dynamic company, where the revenue generating businesses facilitates each brand to go to the market independently and with the ability to scale – creating both financial synergies and synergies in terms of know how.

MeeW consists of a portfolio of legally independent subsidiaries and brands, all fully owned by the Company.

- MeeW STUDIOS, the subsidiary offers end-to-end consultancy by supporting external companies with technology, marketing, communication, and design. The company currently represents the core business of the group, contributing to approximately 99% of the group’s current revenues.

- MeeWINVEST, with the main task to invest human resources in exchange for shares in other companies, so-called sweat equity. Two examples of ongoing investments are Xeer, a cinema and streaming platform based on extended reality (XR) and virtual reality (VR), and Atlantis, a real-estate startup with a disruptive business model that is expected to go live with an app in Q3-23. In both investment cases, MeeW STUDIOS is contracted to design and build the platforms and MeeW INVEST has the right to receive shares when the products go live.

- MeeWInc., a holding company that was established to facilitate the investment of DUEL Inc., which is a social ”X Factor” app that will enable users to do “battles” with each other in creative segments such as music, sports, and craftsmanship.

- CURVEx, a subsidiary that primarily offers a brain scanner as a headband which measures the electric activity in the brain. Via Bluetooth, the headband transmits the signals to an app which informs the subject whether she/he is calm, focused, stressed, or relaxed. The products have been developed since 2018 and were launched on the Danish market in 2021, and sales have almost doubled from DKK 70.2k in 2021 to DKK 135.1k as of September 2022. Attentify is a sub-brand to CURVEx that only focuses on children with ADHD, where some products can be bought through Attentify as well.

- MeeW Audio, a subsidiary that consists of two brands, Politikko, a social podcasting community app for politicians, and OmniPod, a social media app for podcasters who can record and share stories directly in the app. The subsidiary does not contribute with any revenue today, since Politikko is set to be launched during the first half of 2023 and OmniPod is at a Proof-of-Concept level, where the company aims to add premium functions once the product shows traction.

- PhoneLoan has developed an app which will enable private individuals to borrow money from each other according to common contractual terms, allowing individuals to sell expensive goods through peer-to-peer installments. The subsidiary does not contribute with any revenue today, since the app is estimated to be launched during 2023.

- MeeW, the parent company, also owns two brands in the form of Splitshift and nuJob. Splitshift is an intranet for employees, where employees can create profiles, share information, create social groups, and chat forums to facilitate the internal communication within the business. nuJob is a platform for unemployed to search and apply for jobs and for companies to post job advertisements. Both brands have been paused as a result of the Company’s decision to focus on and expand the core business of MeeW, but had more than 30,000 active users before they were shut down.

CONDUCTING AN IPO

MeeW is now strengthening the Company’s cash position through a share issue, prior to the listing on Spotlight Stock Market, which will provide MeeW with a maximum of DKK 18.5m before deduction of transaction related costs, which are estimated too approximately. DKK 2.5m. The majority of the net proceeds of maximum ~DKK 16m are earmarked for increased sales activities and marketing efforts through MeeW STUDIOS, as well as to finance each brand belonging to the Company in order for them to go to the market. This in turn is expected to create value for the existing business and thus contribute to MeeW’s continued growth and expansion.

ANALYST GROUP COMMENTS ON THE IPO

MeeW STUDIOS provides operational support against cash payments, which contributes with cash flow and reduces the operational risk of the group. At the same time, MeeW INVEST receives shares in existing tech companies which gives a large potential upside through ownership in companies in early-stages. Hence, an investor and shareholder in MeeW receives exposure to a broad range of value drivers. Based on our illustrative valuation of MeeW, presented below in our investment thesis, and the pre-money valuation of DKK 40m in conjunction with the IPO, we consider MeeW’s IPO offer to be very attractive. With this in mind, as well as if the stock markets remain positive during the coming weeks, we believe that MeeW presents a very interesting investment opportunity today.

ANALYST GROUP’S INVESTMENT THESIS FOR MEEW

Analyst Groups consider that the subsidiaries MeeW STUDIOS, MeeW INVEST and MeeW Inc. currently form the core of the investment thesis, and the substance of the valuation, where the remaining subsidiaries and brands can be seen as an extra value option in the future. MeeW STUDIOS represent the main business of the group and has experienced a strong growth since 2018, with an average annual revenue growth of 337% (CAGR), where revenues amounted to approximately DKK 20m in 2022. Considering that MeeW STUDIOS stood for ~99% of the group’s revenue in 2022, we think that it is a reasonable assumption that the group’s operating margin of 19% during 2022 is close to equal to MeeW STUDIOS operating margin. To purely illustrate what this could mean in terms of a valuation, we can compare with what similar stand-alone IT consulting companies are valued at. Analyst Group considers that NetCompany, a Danish provider of technological solutions and consultancy services, and CombinedX, a Swedish company that delivers consultancy services within digitalization, are two close competitors to MeeW STUDIOS. These two competitors are bigger companies, however, MeeW STUDIOS has delivered a higher growth with a higher profitability. The competitors are currently (LTM) valued at 12-18x the operating profit, and with the assumption that MeeW STUDIOS should be valued in the middle of this range (15x), this indicates a valuation of close to DKK 60m. Worth noting is that this is an illustrative valuation with relatively simple assumptions, however, we believe it gives an indication of what MeeW STUDIOS could be valued at, solely based on historical figures, i.e., not forward-looking. Hence, even without considering the potential for future growth, which we deem to be very likely, this illustrative and conservative valuation approach for MeeW STUDIOS alone is higher than the total group’s pre-money valuation of DKK 40m in conjunction to the IPO. Also, this is without considering the values within MeeW INVEST and MeeW Inc. The investments in MeeW INVEST and MeeW Inc. are all valued according to the latest investment round, which took place in June to October 2022. Given a conservative assumption that these valuation levels would still remain, even though the investment sentiment was quite bad during that period, and MeeW INVEST’s expected ownership after completed development in the various investment cases, the valuation of MeeW INVEST and MeeW Inc. would be approximately DKK 19m. This valuation, in combination with the illustrative value of MeeW STUDIOS, sums up to a total valuation of the group of approximately DKK 79m, where the remaining subsidiaries and brands are not even included in this illustrative valuation. With that said, this clearly implies that an investor receives a good risk/reward by participating in MeeW’s IPO.